Dumb and Dumber — From the Royals to My HODLing.

Welcome to Wells $treet! It’s good to be back in the saddle, finding funky financial angles behind every story. If you’re new, check out previous articles here, and subscribe to receive this free newsletter directly to your inbox once or twice a week.

💰💰💰💰💰

I’ve been out of the mix for a while, walking across Spain, and I returned to the U.S. with a more forgiving spirit. At least I thought so.

Alas, dumbness continues to rampage across humanity. I feel it is my solemn duty to highlight a few of these blunders in order to teach life lessons and create opportunities for redemption. With that in mind — or to provide sanctimonious cover for my resurgent sarcasm — here’s a roundup of the latest money mistakes I encourage you to avoid.

DUMB — Prince Charles and the Bags of Cash

The Windsors are the most famous family in the world, even more famous than the Kardashians. But unlike the Ks, who earned their fortune the old-fashioned way — through hard work and a leaked sex tape — the Royal Family was to the manor born.

So perhaps it’s no surprise that when a guy has never owned a wallet or couldn’t figure out Apple Pay if his entire kingdom was at stake, it’s no big deal to accept bags of cash from the former prime minister of Qatar, a country that not too long ago was accused by the Saudis (raised eyebrow) of supporting terrorism and Iran.

The Prince of Wales visits Wales, July 6, 2022/Matthew Horwood, Getty Images

In a story from The Sunday times, a Qatari sheikh who used to lead that country’s government allegedly gave Prince Charles and his associates bags of cash totaling more than $3 million between 2011 and 2015. On one occasion, the cash was stuffed into a duffel bag and handed to the Prince during a private one-on-one meeting. Perhaps this is SOP for HRH.

CNN reports the money went to Charles’ charity, “an entity that bankrolls the prince’s private projects and his country estate in Scotland.” (The estate is a charity?)

A spokesman for the Prince says it won’t happen again, and that there was nothing illegal about a foreign ex-official handing valises of money to Britain’s heir to the throne.

Even if it’s legal, it’s dumb.

Dumber — FAA Calls out Airlines for Taking Our Money and Canceling Our Flights

I’ve been in a few airports over the last couple of weeks, surveying the angry and exhausted crowds standing in front of display boards, looking at all the canceled or delayed flights caused by weather or staffing shortages.

Weather, you can’t help.

Staffing shortages? American taxpayers sent the airlines a Covid-survival package worth more than the entire annual budget of the state of New Jersey. Apparently a lot of money was used to buy out veteran pilots so they’d retire early.

Orlando International Airport on July 1, 2022/SOPA Images/Getty Images

The airlines were then caught offguard when travel bounced back. You mean, people wanted to leave their homes after two years? Who couldve predicted that? “The environment we’re navigating today is unlike anything we’ve ever faced,” wrote Delta’s CEO, Ed Bastian.

The airlines are pointing their collective finger at the FAA and blaming a lot of the problems on a shortage of air traffic controllers.

Wellllllll, hold on there, skipper. The FAA pointed a different finger right back. “After receiving $54 billion in pandemic relief to help save the airlines from mass layoffs and bankruptcy,” the agency said in a statement, “the American people deserve to have their expectations met.”

Dumberer — When Bullish Becomes Bullsh*t

Wall Street analysts hate to be Debbie Downers, and an analysis by Bloomberg shows that they continue to be bullish, despite the financial keto diet that’s caused your 401k to shed weight faster than a bride-to-be.

Yes, Peloton imploded. Coinbase may not survive.

But that’s glass half-empty. Half-full is… THEY’RE SCREAMING BUYS RIGHT NOW!

Image by MF3d/Getty Images

“Anyone upset about Carvana’s 90% plunge in 2022 can take heart in the experts’ opinion that it’s due for a 218% rebound,” quips Bloomberg’s Lu Wang and Jess Menton.

The two journalists found that analysts are forecasting hundreds of companies in the Russell 1000 Index will see at least a 50% gain in stock price over the next 12 months, with the median price target 32% above current levels “compared with 12% at the start of the year.”

Some stocks will certainly bounce back, but which ones and when? History has shown that retail investors are often advised to buy stocks all the way down, and the same stocks are slapped with “sell” ratings only after the smart money gets out.

“Analysts are fearful of putting out a sensational shift in their expectations,” portfolio manager Chad Morganlander told Bloomberg (I thought analysis was supposed to be free of emotions like fear?).

We all want Hollywood endings, but on Wall Street, bullish often becomes bullsh*t. Buyer beware. Especially when encouraged to buy.

Dumbererer — Sporting Organizations

LIV Golf is the best thing to happen to the PGA. The alternative golf league has highlighted all that’s unfair to top players on the PGA tour, and it’s also made clear that the U.S. association needs competition. Say what you will about the hypocrisy of selling out by taking truckloads of cash from LIV‘s Saudi-backed owners — looking at you, Pat Perez — but the NFL is the only sports organization that can get away with calling all the shots. Americans love football, NFL players have no viable alternative, and the league is too rich to fail.

Pat Perez and Dustin Johnson at the LIV Golf Tournament in Portland on July 1st/Jamie Squire, LIV Golf via Getty Images

LIV Golf has been accused of being dull and filled with boring players, which gives the PGA an opportunity to wake up and smell the kikuyu grass. Be competitive, not punitive.

Meantime, over in college football, it’s so long, Pac-12! Good job letting “The Conference of Champions” dwindle into The Conference of Irrelevance.

The field for the Pac-12 Championship Game, Dec. 2021/Alika Jenner, Getty Images

USC and UCLA have decamped to the Big 10, and not only for the TV money (which could more than double). Now that “student-athletes” can make money off their names and likenesses, the most promising players want to perform on bigger stages.

As Bill Plaschke writes in the Los Angeles Times, the new conference allows west coast schools to be more successful recruiting talent from other parts of the country, talent that can now play an away game in their hometown stadiums. Perhaps the biggest change, though, is that Trojan and Bruin fans will need to buy something called “a winter coat.”

Dumberererer — The Latest Crazy Insurance Award

A man and a woman have sex in a Hyundai in Missouri on several occasions in 2017. (A Hyundai? Really?) Some of said sex is unprotected. Also, the guy claims they sometimes had sex in other places besides the car.

The woman contracts HPV, a sexually transmitted disease that can cause genital warts. She finds out the guy had HPV but didn’t tell her.

The woman sues the guy for damages to cover her past and future medical costs, along with physical and mental pain and suffering, and since this happened inside his car (did it?), she goes after his insurance company.

The insurer is GEICO, which covers the guy’s Hyundai with both a regular auto policy and an umbrella policy (aha!). They go to arbitration.

The woman wins.

GEICO has been ordered to pay her $5.2 million.

This is the only gecko photo I could license/EThamPhoto/Getty Images

An appellate court has upheld the judgment, and GEICO is now suing in federal court, claiming it shouldn’t be held accountable for something that has nothing to do with the car and may not have even happened in the car.

Best line is from Forbes’ Bruce Y. Lee: “Could 15 minutes or more give you $5.2 million from a car insurance company?”

Dumbererererer — Come to California and Pay More Taxes

California Gov. Gavin Newsom has made quite a splash with a commercial running in Florida promoting California’s commitment to freedom. California also happens to be committed to high taxes, high crime, no prosecutions for shoplifting under $1,000, and over 160,000 homeless people.

The ad was paid for by Newsom’s re-election campaign for governor of California — not Florida — and I think most would agree that it has zero chance of enticing someone who’s paying zero state income taxes in Tampa to pack up the ol’ U-Haul. I mean, sure, come to California! We have no water, and soon we may have no power. Stanford has canceled summer classes because a fire impacted its ability to enjoy reliable electricity.

So yes, please join us in California, where we believe in freedom of choice... if you don’t mind your abortion being performed by candlelight.

Honorable mention: Just-recalled San Francisco DA Chesa Boudin has told the San Francisco Chronicle that he won‘t rule out running again for his old job (which he lost, like, five minutes ago), proof that Donald Trump isn‘t the only ex-politician who can’t read the room.

Dumberererererer — Believing Elon’s Tweets

You knew Elon Musk would make the D&D list, but he’s not the dumb one, even though my colleague David Kerley quotes Elon admitting that some Tesla factories are “gigantic money furnaces,” and even though WaPo reports his deal to buy Twitter may be “in peril,” and even as ”Big Short“ investor Michael Burry threw shade over Elon having twins with a subordinate.

Wait. Maybe he is the dumb one.

No! Not this time. Instead, what’s dumb is that someone actually believed Elon’s hype about the cryptocurrency Dogecoin.

New York investor Keith Johnson is suing Elon for $258 billion, more than Musk‘s current net worth. Johnson alleges that Musk and his companies created a Dogecoin pyramid scheme to pump up the value of the coin before it collapsed. (I’d be curious if Elon bought a bunch of Doge and lost money — I mean, wouldn’t you have to prove he benefited while others suffered?)

Of course, all crypto has collapsed, not just Doge. A minor detail.

“The lawsuit highlights how Musk referred to himself as the ‘Dogefather‘ while promoting his appearance on NBC’s ‘Saturday Night Live’ in April 2021,” reports The Hill. The lawsuit also notes that this was the same appearance where Musk admitted that Doge was “a hustle.”

But if you read through the complaint, two things seem clear: Half of the time that Elon playfully tweets about Doge, he’s only half-serious. The other half of the time, he isn’t serious at all. Go ahead and listen to Elon if you want to learn about rockets and EVs and government handouts, but if you make investments based on tweets that are unrelated to Tesla, SpaceX, Twitter, Boring and Neuralink, that’s kinda dumb.

Dumbest — Um, Me

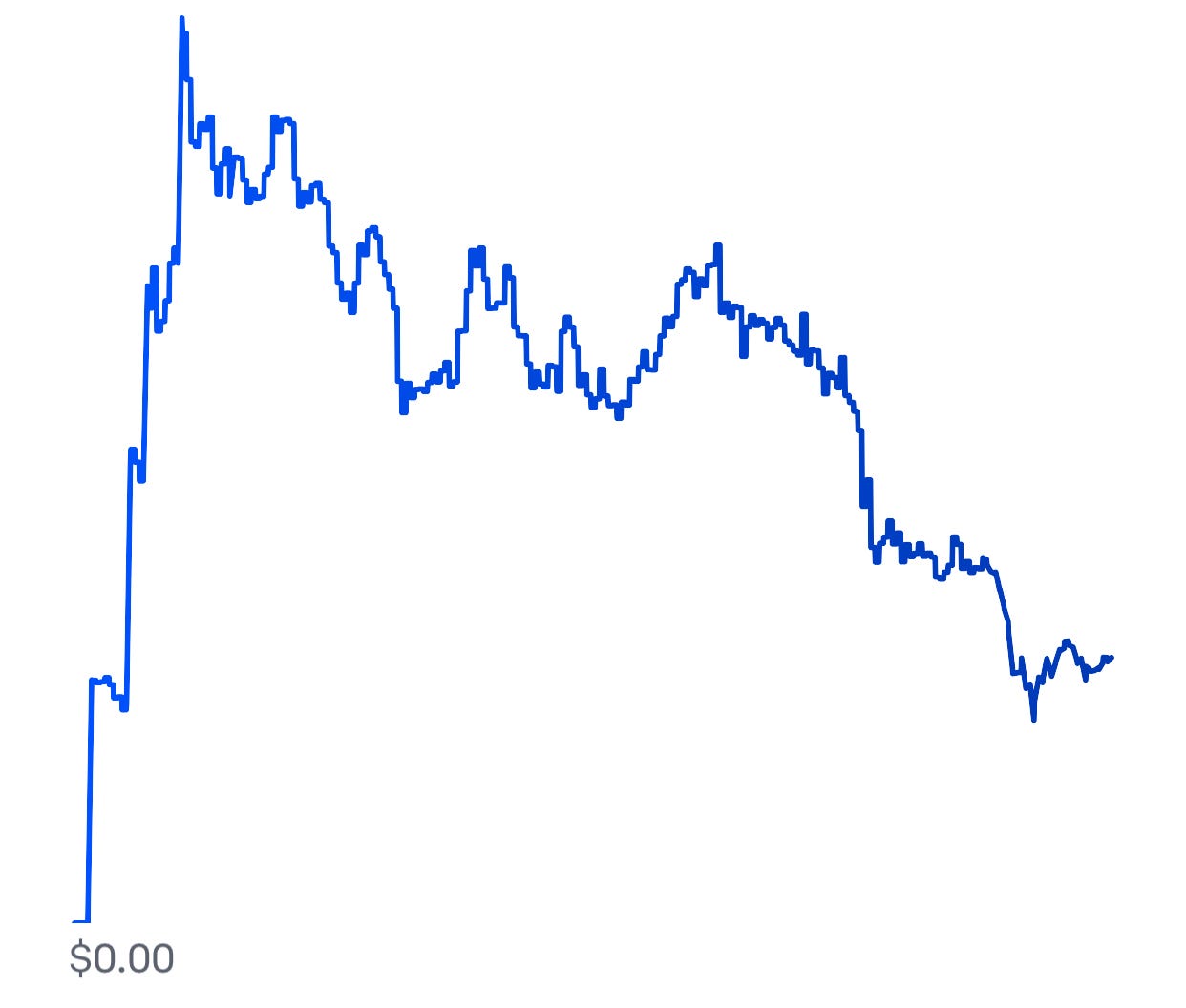

Well, this is embarrassing. As the cryptosphere evaporates, more trading platforms have paused withdrawals due to cash concerns, and some have even filed for bankruptcy protection. Fellow Bulletin writer Zack Guzman reports even the HODLers have sold. (HODL stands for “Hold On for Dear Life.”)

But yours truly still hasn’t sold a bit of her Bitcoin. Or Ether. Or Doge. Or... Shiba Inu.

Yes, I’m out-HODLing the HODLers.

My Coinbase Account’s Performance

I invested in crypto shortly after the peak last fall, because I’m an idiot. And I’ve continued to hang on, believing that someday I’ll regain the 65% (checks chart), er, 72% that I’ve lost in value. Because I’m an idiot.

Sigh.

Finally, Something Wonderful

As I witness my Coinbase account vaporize like Captain Kirk in a transporter, I keep watching this video. It’s just weird enough and sweet enough to soothe my financial fretting. It also inspired me to post my own awkward chicken photo above.

Did I miss anything? Let me know by joining the discussion below. You can also always 📧 jane@janewells.com.

➡️ Follow me on Twitter, Facebook, and Instagram for daily doses of light snark.