The chickens have been coming home to roost in Hitchcockian numbers.

Long-time readers of Wells $treet are acquainted with my Dumb & Dumber columns, where I point our bad behavior that often leads to risky financial outcomes.

Well, what a week!

The head of the Federal Reserve is pranked by Russians. The Trump kids are getting separate attorneys, as Shiv turns against Kendall and Roman (#Succession). A Dr. Anthony Fauci “mea culpa” that includes, “show me a school that I shut down and show me a factory that I shut down,” is missing some culpa.

Over at Fox News, we learned that lying about the 2020 election won’t get you fired from your bazillion-dollar job, but (allegedly) insulting your bosses, posting pin-ups of Nancy Pelosi, and generally thinking you’re irreplaceable, uh, will.

Meanwhile, over at CNN, we learned that you can’t (allegedly) be a jerk forever.

At ESPN, we learned that just because you’re a woman doesn’t mean you can (allegedly) call another woman the c-word.

And at my parent network of NBC, we learned that six years after #MeToo, people in power are still having affairs with subordinates and (allegedly) harassing them.

But you know all this. I have nothing more to add, except don’t put anything in a text or email that you wouldn’t want to see in print or in court.

So rather than focus on the obvious idiocy — Disney v. DeSantis, Fox v. The Truth, Elon v. Stephen King, Regional Banks v. Risk Management, Bud Light v. Anyone Who Actually Drinks Bud Light — I thought I’d weigh in on some below-the-radar financial faux pas.

DUMB — The TikTok Cake War

We begin at the bottom layer of social behavior. Ashleigh Freeman spent $84 to buy a birthday cake from Kylie Allen, owner of Kylie Kakes in Princeton, West Virginia.

The cake was a disappointment, and Ashleigh complained. (If her photos accurately depict how the cake looked when she picked it up, she has a point.)

The two women reportedly exchanged increasingly angry emails and texts, and finally Kylie (the baker) went on TikTok to complain about her customer, without naming her.

Then Ashleigh went on TikTok to complain back. Then Kylie kicked it up a notch. Then Ali Wong tried to destroy Steven Yeun’s construction business, and then he peed all over her bathroom.

Oh wait, that’s “Beef,” on Netflix.

Same idea. Anyhow, the whole internet got involved, and the ensuing social media war has been far costlier for both women than $84.

I never thought I’d miss the good old days of abject poverty, but this is what happens when people have too much time on their hands (she says while typing her silly newsletter in Kona). Back when our forebears toiled all day and collapsed every night exhausted, no one would think to complain about a cake. They didn’t have cake.

DUMBER — Believing Bad Girls

The conventional wisdom is that everything would be better if women were in charge. Women listen, we have empathy, we collaborate, blah blah blah zzzzzzzzzzzzzzzz.

It is true that women can perform as well as men, sometimes even better. We can even lie, cheat or steal with the best of the boys.

While Elizabeth Holmes (Stanford) has grabbed most of the criminal headlines that don’t include CEOs with a Y-chromosome, 31-year-old Charlie Javice (Wharton, class of 2013) may be asking “hold my beer!” from an adjoining cell.

Javice is the founder of Frank, a company that helped college students find financial aid. J.P. Morgan bought the company in 2021 for $175 million, a deal that would reportedly net Javice $45 million. But the bank, along with the the U.S. Attorney and the SEC, now believe Javice wasn’t frank about Frank’s customer count.

Instead of four million clients, the feds say Frank had fewer than 300,000.

“Months after the transaction closed,” CNBC reports, “JPMorgan said it learned the truth after sending out marketing emails to a batch of 400,000 Frank customers. About 70% of the emails bounced back.”

J.P. Morgan sued for fraud, the SEC soon followed, and then Javice was arrested on criminal fraud charges. She’s free on $2 million bond.

According to various court filings, one of Javice’s engineers questioned her manipulation of customer data, but she assured him, “No one would end up in an ‘orange jumpsuit’ over it.” The engineer, probably knowing that when a CEO says this, someone does end up in an orange jumpsuit — usually the engineer — refused to play along.

Look, you can get away with lying to the government and to investors and to the American people, but don’t mess with J-P-FREAKING-MORGAN.

Frank has been shut down, and Javice faces 30 years if convicted. “A spokesman said she denies the allegations.”

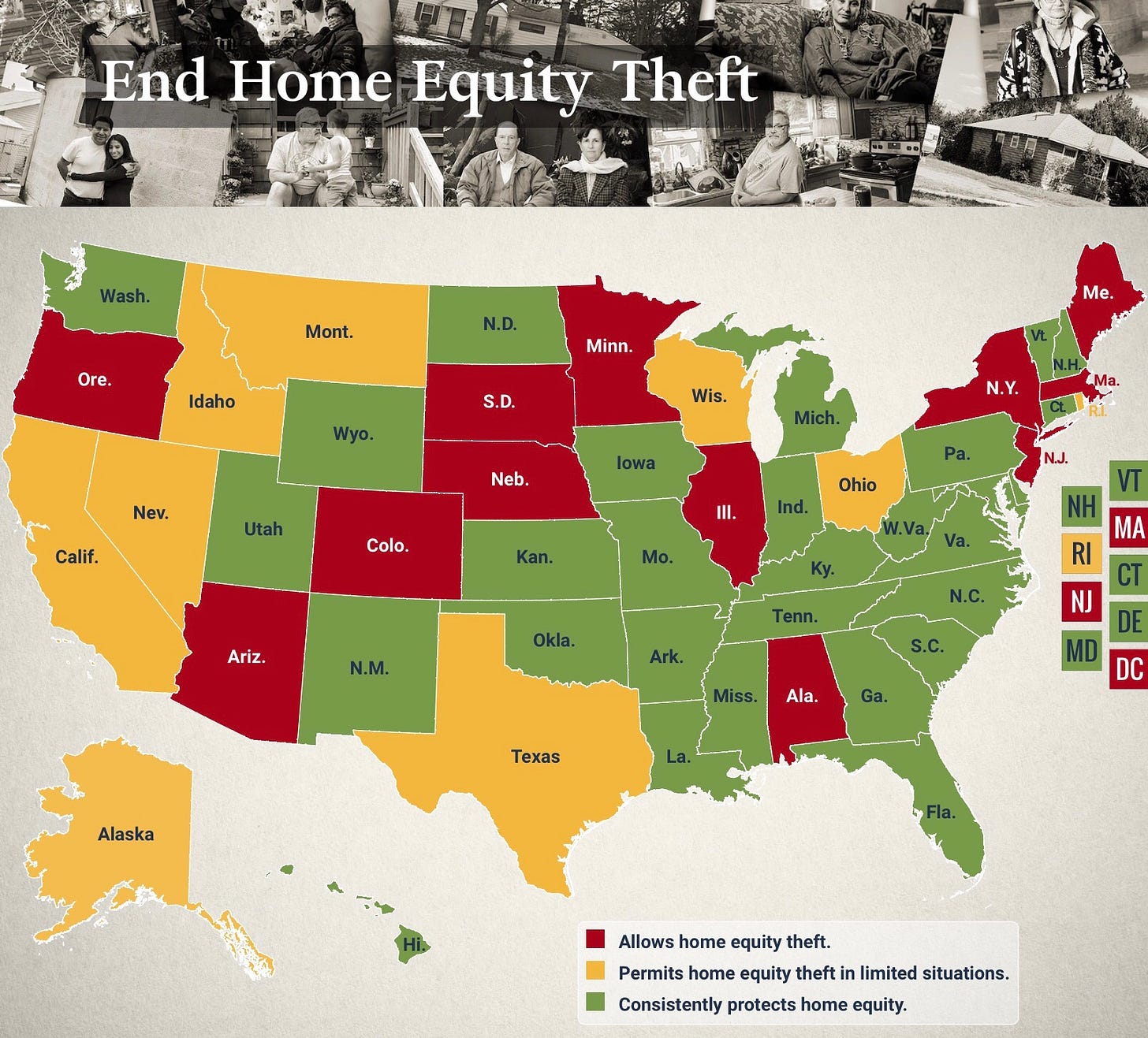

DUMBERER — Legal Theft

There’s illegal theft (alleged above), and then there’s government-supported legal theft.

We all know that if you don’t pay your property taxes, the government can take your house and sell it to pay the bill. Whatever proceeds from the sale beyond the tax debt go back to the former homeowner.

At least that’s what I thought.

According to the Wall Street Journal and the Pacific Legal Foundation, over a dozen states allow the government to keep ALL the proceeds of a forced sale. It’s called “Home Equity Theft.”

For example, 94-year-old Geraldine Tyler fell behind on the taxes of her one-bedroom condo in Minneapolis. With late fees and interest, the debt ballooned to $15,000, and the county seized the property and sold it for $40,000.

It kept the entire $40,000.

The Journal points to other cases where this has happened. “In Washington, a veteran struggling with dementia lost his $200,000 home because he missed $133 in taxes.”

The case of the little old lady from Minnesota is going before the Supreme Court. Her lawyers seek to overturn the law under the Fifth Amendment (government can’t take property without just compensation) and the Eighth Amendment (no excessive fines or cruel and unusual punishment).

The high court has been making a lot of headlines recently (abortion pills, Clarence Thomas’ weird friends), but let’s hope the justices carve out some time to rule in favor of fairness.

DUMBERERER — Buying Stuff That’s Not Real

If you decided against purchasing an NFT last year, good job! Prices for “non-fungible tokens” collapsed in 2022 as much as 90%.

Now an employee at the largest marketplace for buying and selling the tokens is being tried for insider trading. Nathaniel Chastain was a product manager at OpenSea, and federal prosecutors accuse him of buying NFTs before they were put up for auction, then selling them for profit, “abusing his position of trust.” Chastain’s attorneys say the company had no rule preventing this at the time.

But… is this insider trading? That usually applies to stocks, and NFTs are not securities. So what are they?

This leads to the bigger question about everything crypto. Are digital currencies, like Ethereum and Doge (and the things they’re used for), assets, or are they commodities, or maybe securities?

Federal regulators have been promising to tell us, but SEC chairman Gary Gensler has only said that Bitcoin is a commodity. He’s provided no guidance on anything else, even while threatening various regulatory actions. Gensler was grilled by pro-crypto congressional members this month, trying to pin him down on answers. Now Coinbase is trying to force the issue in court.

All of this is to say that there’s a lot of confusion. And where there’s confusion, bad things happen.

DUMBEST — The Unfair Fair and the GOAT of Government Overreach

I was going to rage about parents who spend up to $75,000 on their childrens’ birthday parties. But then I realized that $75,000 is going into the economy and paying people — planners, balloon-blowers, cake makers — who turn around and pay it forward with their own spending (plus taxes). So, yay! Throw Isabella a “KidChella” party, but maybe skip the “ill-advised American Indian headdress.”

So instead of venting about budget-busting birthdays, I’m going off about a $900 goat named Cedar.

Deep breath. Here goes.

A nine-year-old California girl raised Cedar to be auctioned off at the Shasta District Fair. Like all (human) kids who do this for 4-H, she knew the (goat) kid would be slaughtered after the sale.

But after Cedar was sold for about $900 to a California state senator, the little girl couldn’t go through with it. She begged fair officials to let her keep Cedar. They said no. So she and her mother took the goat and left.

According to a federal lawsuit (because this is now a federal lawsuit), the girl’s mother offered to pay fair officials the $900, and she even received permission from the buyer to do so.

However, fair management reportedly insisted that the goat be returned, because rules and rules, and when that didn’t happen, they filed a police report alleging theft.

Somehow, the Shasta County Sheriff’s Department received a search warrant (who was that judge?), and two deputies reportedly drove 500 miles searching for the goat, eventually locating it in another county. They captured Cedar and returned the animal to fair officials, who had the goat summarily slaughtered.

Wow.

The girl’s lawyers argue that as a minor, she has the right under California law to terminate a contract “within a reasonable time.” At most, they say, this was a civil case due for small claims court, not a crime meriting a search warrant and the use of law enforcement. “It’s a little girl’s goat, not Pablo Escobar,” her attorney told the Los Angeles Times.

And why rush to kill the goat when its ownership was being disputed?

Management at the fair isn’t commenting because of the pending litigation, but the girl’s mother showed the Times an email from officials explaining their reasoning. “Making an exception for you will only teach [our] youth that they do not have to abide by the rules,” she was told.

If “abiding by the rules” means breaking the hearts of children who are having second thoughts about a contract involving a 4-H animal, then there’s something very unfair about the state of affairs.

Plus, that $900 is gonna look like chump change by the time this is over.

DUMB BUT WONDERFUL — Taylor Swift and some Korean American Pie

I always like to end on a high note! This time, literally.

First, it’s an especially tense time on the Korean Peninsula. There’s a nuclear-armed madman up north bolstered by the world’s second largest economy. No wonder South Korean President Yoon Suk Yeol wanted to let off a little steam singing karaoke this week. He chose a classic hit for his White House debut, Don McLean’s “American Pie.”

This is my kinda state dinner.

Finally, I’m not one of those “Swifties” who thinks Taylor Swift walks on water. However, I have tremendous respect for her. She’s fearless in protecting her career and image.

Case in point: While many celebrities — from Tom Brady to Steph Curry to Larry David — took money from accused fraudster Sam Bankman-Fried to promote his now-defunct FTX, Taylor Swift walked away.

According to a lawyer representing FTX investors suing the other celebrities, only Swift asked her lawyers to do some due diligence on the crypto-trading platform. Only Swift asked for assurances that the products she’d be hawking “were not unregistered securities.” (Good question, Taylor, see above. Not even Gary Gensler seems to know).

The singer passed on the deal, even though FTX was (allegedly) offering $100 million. Forbes lists Taylor’s net worth at $570 million, and $100 million is meaningful. You can’t just shake it off.

But she did.

💰💰💰💰💰

I have missed Dumb and Dumber. Welcome back! You still have it. Maybe you should spend more time in Kona.

I always feel so much smarter after I read your columns, Jane. Thanks! Writing from Kona, eh? Good for you.