Yikes! Your Tax Dollars vs. Government Spending

Here at Wells $treet I follow the money. Sometimes it’s funny money, as in something doesn’t add up. And sometimes it’s money that’s funny, like the bar showing only women’s sports on TV. It’s called The Sports Bra.

If you’re new, welcome! If you like what you see, subscribe and share with money-minded friends and family. Catch up on my previous gems of journalism here.

💰💰💰💰💰

The government is going to partially shut down Friday if Congress doesn’t pass another spending bill.

Oh dear, said no one (other than those who won’t get paid).

If we ran our personal finances the way the U.S. government manages its budget, we’d be living in a van down by the river surviving on a steady diet of government cheese.

I’m sure you read the monthly statements from the federal government detailing its income and spending.

Of course you don’t. You’re normal. I read them so you don’t have to.

I’ve decided to share with you the latest monthly snapshot from the U.S. Treasury Department because you might find it both informative and unintentionally funny, in a depressing sort of way.

Fasten your battered, worn out, underfunded seatbelt. We’re going down a bumpy rabbit hole.

Spending Like a Firehose

How much did the U.S. government earn in August? The feds took in $304 billion for the month.

But they spent $523 billion. That’s nearly 72% more going out the door than coming in (a disparity not dissimilar to my occasional overspending on Amazon after three margaritas throughout the lockdown of 2020 — at least I got some cool shoes out of it; taxpayers ended up paying AOC and MTG).

August is a particularly bad month for the budget because there are no tax deadlines. So I also looked at the entire fiscal year so far. Over the first 11 months, the feds took in $4.4 trillion and spent $5.4 trillion.

The national debt is currently (gulp) $31 TRILLION, up from $28 trillion a year ago. With 330 million people in the U.S., that breaks down to a staggering $94,000 of debt per American.

This continued practice of not bringing in sufficient income to cover one’s expenses is troubling, especially at a time of low unemployment and higher wages. I mean, it’s not gonna get much better than right now for the tax man. And the government is paying ever-higher interest on our growing debt.

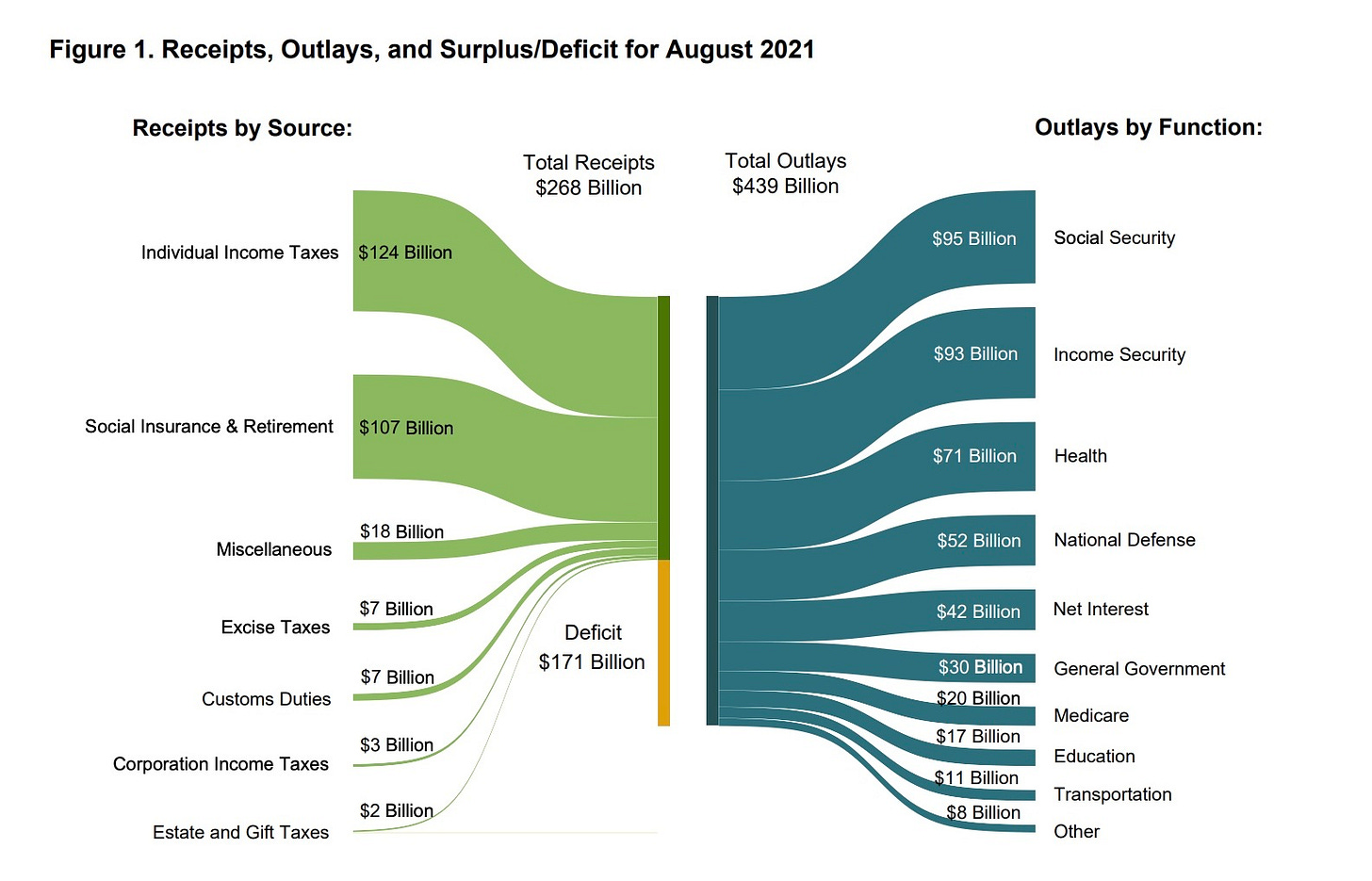

Here’s the balance sheet for August alone:

Source: U.S. Treasury Department

Compare that to August a year ago:

Source: U.S. Treasury Department

And here is the fiscal year to date:

Source: U.S. Treasury Department

Some things in the August report popped out to me, like the $16 billion in “miscellaneous” income. That’s a lotta odds and ends. As best as I can determine, “miscellaneous” includes fines and forfeitures paid in federal cases. It also includes interest money earned by the Federal Reserve from securities it owns (which may include U.S. debt the Fed essentially issued and then bought to keep liquidity in the financial system — a classic case of robbing Peter to pay Paul).

There’s also “other” income noted further down in the report. “Other” is different than ”miscellaneous,” and may include estate taxes.

On the spending side, we shelled out $63 billion for net interest and another $63 billion for defense, meaning we spent the same amount of money to service our debt as we did to defend the nation. (And we’re gonna need a strong defense if we ever default on that debt and foreign governments— *cough* China *cough* — insist on collecting, amirite?)

There’s also $25 billion spent on “other,” which is… I don’t know… different from “miscellaneous.”

Next I dug into the mind-numbing pages outlining how funds are funneled through various federal agencies. Here are a few eyebrow-raising examples:

— $1 million in August came from taxpayers who voluntarily withheld $3 from their income taxes to fund presidential campaigns. #insane

— $33 million went to the architect of the Capitol. For what, it doesn’t say.

— $141 million went to the House, $92 million to the Senate. Can I ask for a refund?

— $1.9 billion went to federal crop insurance. This is the taxpayer subsidy Americans pay farmers to protect them from market forces that the rest of us aren’t protected from.

— $13 billion in food stamps, and also $13 billion to pay members of the military.

— $18 billion went to federal direct student loans, which will probably be forgiven...

— Meantime, NASA received a mere $640 million for exploration missions designed to get us off this rock (or save us from a rock) before we go bankrupt. For something cool that I support spending money on, skip to the one hour and 17 minute mark:

I reached out to Treasury to ask if someone could explain how they gather all this massive information, and what sort of due diligence is done to make sure it’s accurate. Who’s asking for receipts?

Ever optimistic, I’m standing by for a reply!

You know, one positive thing about being a sovereign nation is that you can print your own money. The negative thing is that you can print your own money. Have a deficit? Print more money! Sell more bonds!

Looking at monthly reports going back to 1980, I noticed we’ve only been in the black 5% of the time, and most of those months were Aprils, when everyone mailed in their taxes.

Finally, holy mother of God, there’s also a daily Treasury statement. For example, one day last week the greatest income — aside from the $700 billion in debt transactions (the printing money part) — came from individual income taxes at $7.7 billion dollars. For a single day.

The greatest withdrawals that day went to defense contractors ($2.8 billion), the Department of Education ($1.5 billion), Medicaid grants ($1.4 billion) and “unclassified” at $1.6 billion (the documents at Mar-a-Lago, heh heh).

FYI, plenty of entities received zero federal dollars on that single day, including the Corporation for Public Broadcasting, IRS refunds for Puerto Rico (which could use the money right now to turn the lights back on), the FDIC, and the District of Columbia.

I support zero money going to DC every day… at least to Congress.

💰💰💰💰💰

Once your blood pressure returns to normal, please leave a comment! Or share your rant via email — jane@janewells.com.

Cover image: DigitalVision/Getty Images

➡️ Follow me on Twitter, Facebook, Instagram, and LinkedIn!

Up next: Dumb & Dumber, coming Friday. And next week, a story about people who *want* to go back to the office.