Crypto has become Kryptonite.

Nearly everything it touches is going belly up, whether it’s the value of coins, the death of exchanges, the lenders who promised 8% returns, or miners who overspent on equipment to make blocks in the blockchain to earn crypto that now isn’t worth enough to cover their investment.

If I’ve lost you already, don’t fret. Just know it’s really bad.

Last August — a million years ago in crypto-time — Forbes reported that across several exchanges, half of all Bitcoin trades were “likely to be fake or non-economic.” Why? So exchanges could make trading look more popular than it really is.

A snarky software engineer named Molly White is keeping a tally of dark developments with a blog called “Web3 is Going Just Great.”

You could argue that the current digital debacle is akin to the dotcom bubble burst of 2000, a tech collapse that cleared the field of unprofitable businesses (Pets.com), leaving an ash heap from which so many massively successful phoenixes rose (Facebook).

Or maybe it’s more like the financial collapse of 2008, a mortgage-backed house of cards that crumbled, leading to new regulations.

Zack Guzman thinks it’s a mix of 2000 and 2008.

“As a reporter covering all this, I think I need to go to therapy,” he jokes. “People love to hate on crypto, and people who are in the crypto world love to hate on people who don't understand it.”

No one may be a bigger crypto hater right now than John Reed Stark, the former head of internet enforcement at the Securities and Exchange Commission. He let loose on LinkedIn:

“Why do the crypto-dominoes continue to fall at such an accelerated pace? Because the perilous crypto-ecosystem is a mammoth, opaque and incestuous clandestine marketplace with no transparency, no meaningful regulatory oversight and no consumer protections. It’s a post-apocalyptic Walking Dead like anarchical free-for-all and one big hustle orchestrated amid a toxic and devious fintech den of thieves. … In fact, never in the history of securities fraud have prosecutors and regulators had at their disposal such an extraordinary bevy of anxious and enthusiastic stoolies, canaries, turncoats, snitches, tattletales and tipsters. My take: Expect a lot more crypto-bank runs to trigger, a lot more crypto-defendants to be charged and a lot more crypto-story to be told.”

I’m gonna guess he’s not HODL-ing any Doge. (If you don’t get that line, believe me, it’s hilarious.)

Some investors who’ve lost money are going after the celebrities who touted crypto. Hello! Getting into this “opaque and incestuous clandestine marketplace” based on a pitch from Tom Brady or Madonna or Logan Paul is like buying a Jane Wells-approved jock strap.

It calls to mind the early internet of the ‘90s and those first attempts to use Netscape via a dial-up connection slower than a Joe Biden walk across the South Lawn. Who needed the World Wide Web? What was the point?

Well, back then, the point was porn.

And then people began using the internet to find someone to date, and then to search, shop, catch up with friends on social media, follow Elon Musk on Twitter, stream incredible entertainment on Netflix, blah blah blah.

I wanted to know if there is some as-yet-unknown great purpose for Bitcoin and NFTs and exchanges and lenders and crypto miners, something beyond conducting business without a bank or buying a cartoon of a bored ape. I mean, our traditional banking system works pretty well —plus, it has protections! — and it survived the crypto collapse with nary a scratch.

So I asked Zack to join me on Facebook Live.

Zack used to work with me at CNBC before he moved on to Yahoo. We first talked about crypto last March. Now he’s co-founder of Trustless Media and host of Coinage, a media venture producing an online show about crypto that’s owned by the audience. People purchase a digital “ticket” to join Coinage, which functions as a sort of cooperative — kinda like REI. Zack’s goal is to cover crypto honestly, with an audience made up of competing viewpoints steering topics of discussion. What if you “owned” the nightly news and could collectively weigh in on what was covered, instead of being spoon-fed stories from editors in New York? That’s kinda the idea.

Zack took startup money for this project from crypto rivals in an effort to avoid a particular bias. Some of that money came from Sam Bankman-Fried’s Alameda Research (back when it had money) and from Do Kwon, the guy behind the Terra coin fiasco, who’s currently on the lam from South Korean authorities.

More on that later.

I like Zack because he’s a smart guy who’s been following the industry for years, and he remains both a believer and a skeptic; someone who’s got skin in the game but who also has no problem calling out bad actors and bad ideas (including his own mistakes).

Here’s what I learned from our conversation.

A Very Brief History of How We Got Here

Skip ahead if you already know this part.

The crypto collapse began when a so-called “stablecoin,” Terra, failed, wiping out $50 billion. Luna, a sister currency it was tied to, also went down.

Without getting into the weeds, Terra collapsed when someone(s) sold a bunch of it — like, a ton of it — driving down the price. Then other people who owned Terra and Luna started selling to cut their losses, and the prices fell so much that the whole thing went kaput. It caused a cascade of catastrophe that financially obliterated individuals, exchanges and lenders in the crypto universe. The bankruptcy courts are going to be very busy this year.

Zack compares the collapse of Terra to the destruction of the British pound in 1992 by billionaire George Soros, everybody’s favorite Democratic donor. Soros saw that the pound was overvalued, that it was artificially pumped up by the British government, so he shorted the currency to the tune of $10 billion. This allowed Soros to borrow pounds at a fraction of their worth and dump them on the market, driving down the price. The more the price fell, the more he made. Soros ended up pocketing an estimated $1 billion profit.

Soros’ gambit brought the British financial system to its knees, until the UK government stepped in to save it.

There’s no such backstop in crypto.

So who was the “Soros” of Terra, the person who ushered in the crypto collapse? “That, to me, is another interesting turn of events,” Zack tells me. He points to stories suggesting that none other than Sam Bankman-Fried may have been behind the Terra terror. The Justice Department is looking at whether SBF’s Alameda Research shorted the coin to destroy Terra, thereby removing a rival from the marketplace.

I have no idea if SBF started the collapse, but if he did, well, karma…

So Now What?

An estimated $2 TRILLION was wiped out in crypto assets in 2022, though it’s hard to know what’s really real.

We’re left with a bunch of coins of varying (low) value, a few exchanges like Binance and Coinbase that claim to be healthy, and — I dunno — a lender or two. The entry price to buy popular NFTs like the Bored Ape Yacht Club has come down. Some NFTs are worth nothing at all.

That doesn’t mean all crypto is bad. Like the aftermath of the collapses in 2000 and 2008, the tide has gone out and revealed a lot of stupidity and criminal behavior. Prosecutors claim Sam Bankman-Fried engaged in good old-fashioned fraud. It’s as if Elizabeth Holmes issued a BloodCoin in 2014 and secretly took depositors’ money to fund Theranos. (I would’ve totally bought a BloodCoin. #Idiot)

New regulations won’t stop criminals from committing crimes, though that doesn’t mean there shouldn’t be more regulation around crypto. But Zack is concerned that the government will over-react, as it often does. “Congress doesn’t know how to regulate crypto, and crypto doesn’t believe it needs to be regulated,” he says. “People have the right to trade certain things that they want to.”

So…

Trust No One

Many of us have forgotten that the whole point of crypto is to be outside the normal banking system, but that also means being outside a system with oversight and protections.

Crypto was set up so that you don’t need to trust anyone, including the person on the other side of your transaction. The blockchain was created so transactions could be be processed and recorded by independent miners, piece-by-piece, and everyone could watch, assuming you knew where to look (I don’t).

But people began trusting crypto. They believed the promises of “banks” offering 8% returns, even though these lenders had no FDIC insurance. “Why do we have crypto lenders in the first place?” Zack wonders.

Bottom line: These are not normal financial institutions. Understand your risk.

Zack: Bitcoin and Ethereum Will Survive and Bounce Back

“I think Bitcoin and Ethereum have proven themselves at least trustworthy in the sense that their technology works,” Zack says. Their blockchains functioned as everything else fell apart last year.

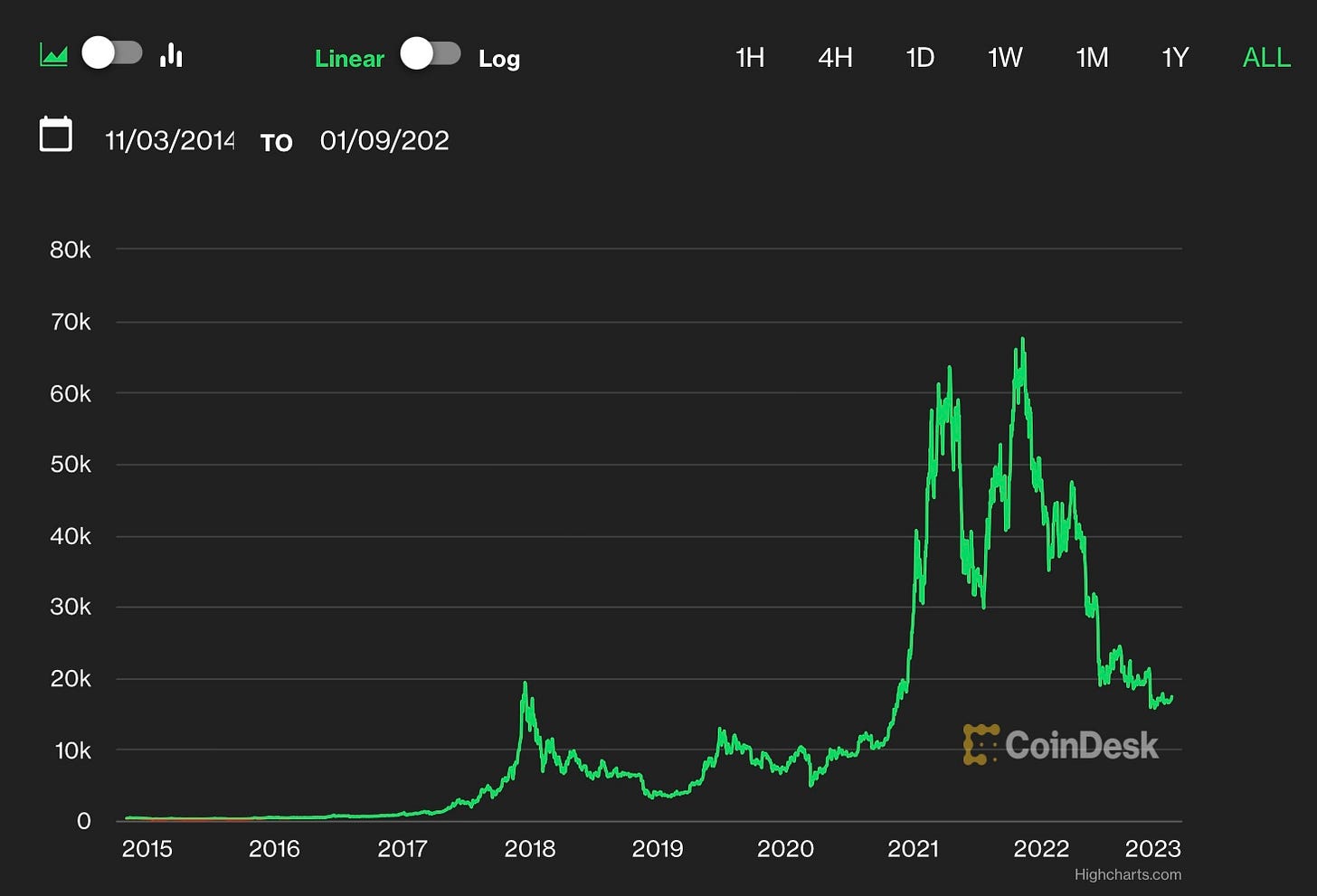

Even though Bitcoin lost 64% of its value in 2022, it’s still higher than it was in 2020, and the coin has hung on for almost 14 years. “It always comes back,” Zack says. Here’s a Bitcoin chart from CoinDesk.

You can see that the price has collapsed before. Zack thinks that since this particular collapse happened faster, the rebound may also be faster. This year, he says, “My call would be that we see a bottom [and] a triggering of the next wave.”

Bottom line: Bitcoin and Ethereum have legs. Be careful about everything else.

Zack: Crypto 2.0 (aka Web3) Might Let You Own and Sell Your Own Data!

Why should I care about cryptocurrencies? Maybe I’d care if I lived in a country where I didn’t have a relatively trustworthy banking system. But I live in the United States. I’m good. (Though keep an eye on those Wells Fargo fees. Heh, heh.)

So the big question now is how could this technology — these crypto tokens — be used for something actually game-changing? Bored Apes aren’t game-changing.

Well, here’s an idea. Zack thinks one thing digital tokens could do is flip the traditional relationship between consumers and advertisers. Rather than surfing the net and being a passive player whose data is sold by a tech behemoth to marketers, you could own your data and sell it yourself. Your data could be a token that someone would pay to access. I’m scratching my head, but I like this idea…

Bottom line: We still don’t know the technology’s potential, but use your imagination. There’s a crypto Mark Zuckerberg or Jeff Bezos out there, someone who’s going to figure this out and make a killing.

Zack: Own Your Own Wallet

Zack prefers to keep much of his crypto in a personal digital wallet rather than on an exchange, especially since bankruptcy courts are suggesting that some assets in crypto banks may not really belong to you.

Apps like Trust Wallet and Rainbow (for Ethereum only) let you do this— though I also wonder how safe you are using an app!

But Zack says there are still risks possessing your own crypto. “You have to write down the seed phrases and store those safely somewhere.” In other words, lose your passcode and good luck ever accessing your wallet. Also, if anyone finds your “seed phrases,” they could drain your account.

Bottom line: Keeping crypto under a digital mattress might be safer. Just don’t forget your passcode.

What’s SBF Like?

Zack has interviewed Sam Bankman-Fried and describes him as “a very quirky guy… very quick on his feet… docile in nature.” Here’s an interview they did in June, 2021.

As I mentioned earlier, when Zack left Yahoo to start his new media venture, he approached SBF to invest in it, and the now-disgraced former billionaire did. He also received money from Do Kwon, whose Terra project may or may not have been destroyed by SBF.

Zack is astonished at how the mighty have fallen. Still, he admits, “The warnings signs were there.”

Like what?

In the case of Bankman-Fried, Zack says SBF released the financials of FTX (his exchange) and Alameda (his investment firm) to Forbes in 2021, when he landed on the magazine’s “30 Under 30.” Those balance sheets indicated that much of the value of Alameda was in a crypto token created by FTX. In other words, one side of SBF’s empire created “money” for the other, and nobody seemed to see a problem with that. Zack says the token was “essentially illiquid.”

It wasn’t until CoinDesk started digging into FTX that anyone paid attention. What took so long? “There were certainly detractors and critics,” Zack says, but in the crypto world, “if you’re a critic of any of these projects… immediately you’re shouted at and cast aside as just someone who’s attacking a project.”

Bottom line: Ask questions. Follow the money.

The Big Surprise: Satoshi Hasn’t Touched His Wallet

Here’s something to consider after everything that’s happened.

Satoshi hasn’t sold any Bitcoin.

Satoshi Nakamoto is the name given to the person or people who created Bitcoin and launched it in 2009. No one knows who Satoshi is, or at least they’re not saying if they do. Some claim Satoshi is the NSA or the CIA or Elon Musk.

Whoever he/she/they are (assuming he/she/they are still alive), Satoshi owns a ton of Bitcoin in a wallet — one million coins — a wallet that has never, ever been touched. Not once in 14 years.

If that wallet was opened and all that Bitcoin was unleashed onto the market, it would create what Zack calls the third rail of the crypto apocalypse. Prices would collapse. Anything still standing might fall.

But that hasn’t happened.

Satoshi’s wallet has remained sealed and silent since 2009. “The anonymous founder is still anonymous,” Zack says with amazement.

Bottom line: The security of an entire financial ecosphere depends on the prudence of an anonymous player.

Maybe he forgot his passcode.

One more thing…

I Asked a Bot to Explain the Blockchain

ChatGPT is all the rage because it’s an app where a bot answers your questions in a much clearer and more conversational way than Google or Siri… or me. The ramifications could be far-reaching. Here’s a great discussion on how the app could replace the need for writers.

Anyhow, I asked the bot, “How does the blockchain work?”

Here’s its reply.

You can see why professors fear they can no longer trust the authorship of a term paper.

🤖🤖🤖🤖🤖

Do you own any crypto? Would you? What potential use for it could turn you into the next Mark Zuckerberg or Jeff Bezos? Leave a comment and I’ll reply! (Myself, not ChatGPT.)

And right on cue, SBF has joined Substack! Presenting his side without cross-examination. Basically: we did nothing wrong except we were too late to hedge against a potential market collapse, bad things happen in the markets, and what happened to us has happened to others. A gift for the prosecution? https://sambf.substack.com/p/ftx-pre-mortem-overview

Bitcoin, blockchain, and ChatGPT all in one piece. Love it. I am still a believer the blockchain technology is strong and useful. I remain skeptical of its current well-known uses. Jane... your sub-headline is the key!